By Thomas Huelskoetter

May 18, 2018, 6:30 am - Center for American Progress

Last year, as part of the tax law, Congress eliminated the Affordable Care Actfs individual mandate penalty. Given the mandatefs important role in encouraging healthier people to enroll in the marketplaces, the Congressional Budget Office (CBO) estimates that, in 2019, this will increase average premiums in the individual market by 10 percent.

Furthermore, in February 2018, the Trump administration proposed a rule to expand short-term health insurance plans. As indicated by their name, short-term plans are intended as temporary insurance coverage, generally to help people manage transitions between different sources of coverage. Yet the Trump administrationfs rule would expand their duration so that they could become a long-term source of coverage. These plans generally do not comply with the ACAfs protections for people with pre-existing conditions.

Along with the repeal of the individual mandate penalty, this expansion of short-term plans will drive up average premiums for ACA-compliant coverage in the individual market. Recent preliminary rate filings in Virginia demonstrate that these actions are contributing to significant premium increases for marketplace coverage in 2019. In fact, some Virginia insurers specifically cited the individual mandate repeal and short-term plan rule as major factors in their rate filings.

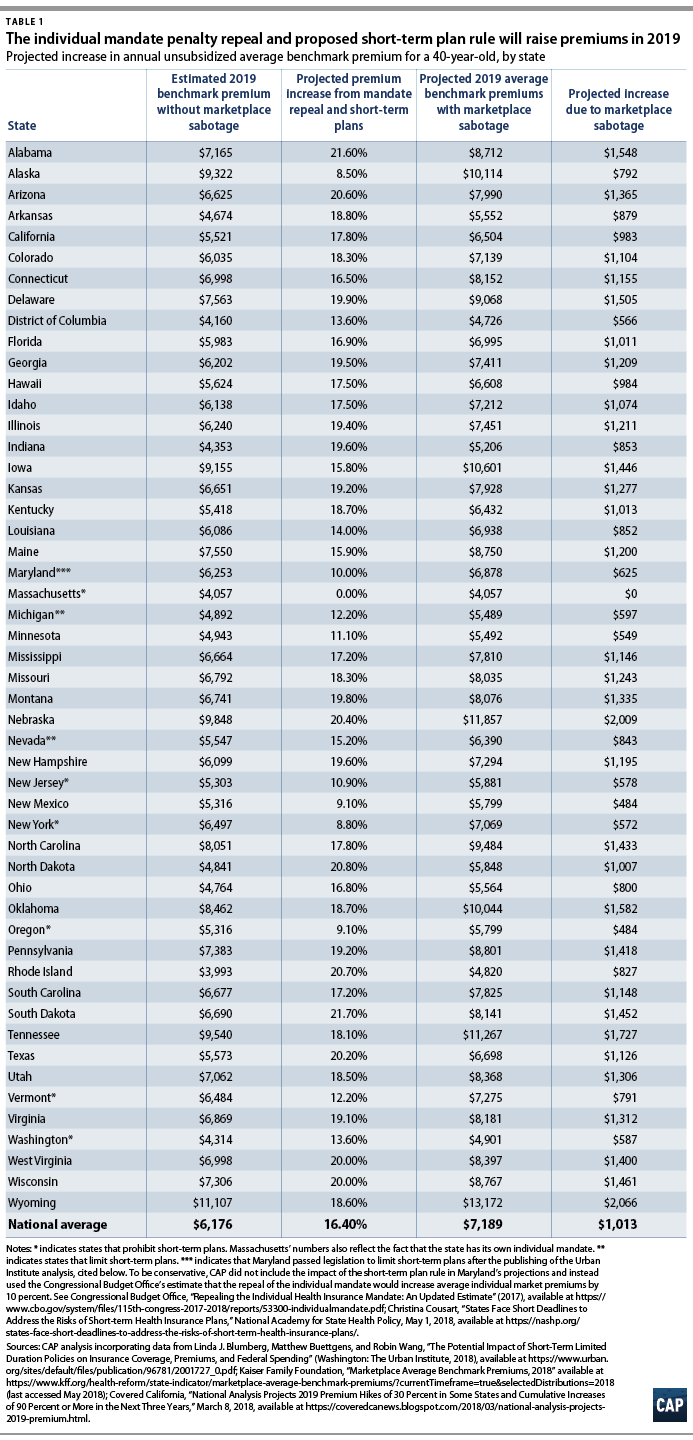

Using estimates from the Urban Institute, this column projects average state-by-state premium increases for 2019, in dollars. Estimated premium increases due to these acts of marketplace sabotage average $1,013 nationally for benchmark premiums for a 40-year-old individual.

The individual mandate was an important complement to the ACAfs consumer protections, including the ban on insurers discriminating against people with pre-existing conditions. Without the individual mandate, some healthier enrollees may decide to go without coverage and wait until they get sick to enroll. Since this would leave the remaining pool of enrollees less healthy on average, it would thereby drive up average premiums in the marketplaces.

Similarly, short-term plans also pose a threat to marketplace stability. The Trump administrationfs proposed rule would significantly expand the scope of short-term plans compared with the current regulations. It would lengthen the allowable duration of short-term plans from three months to 12 months, and it would permit them to be continually renewed by the issuer. By enabling short-term plans to function as an annual, renewable source of insurance, the rule would effectively turn them into a parallel market for insurance.

This expansion is problematic because short-term plans are exempt from the ACAfs consumer protections. As a result, short-term plans can discriminate against people with pre-existing conditions; impose lifetime or annual dollar limits on coverage; and charge women higher premiums than men. They are also not required to cover all of the ACAfs essential health benefits; short-term plans often exclude important benefits—such as maternity care, mental health care, and prescription drugs—from coverage. A recent review of the short-term plans offered across the country by two insurers found that out of more than 600 short-term plan options, on average, only 29 percent covered prescription drugs while not a single plan covered maternity care.

Due to these limitations, people who enroll in short-term plans may find that these gjunk plansh do not cover the care that they will eventually need. Furthermore, short-term plans have the potential to divert healthier people from the ACAfs insurance marketplaces, weakening the risk pool and driving up average marketplace premiums—including for people with pre-existing conditions, who would largely be locked out of the short-term plan market.

Combined, the recent tax lawfs repeal of the individual mandate and the administrationfs short-term plan rule will undermine the individual insurance market and increase premiums for ACA-compliant coverage.

Using the Urban Institutefs projections of the average percent premium increase due to these two actions, CAP estimated the potential premium increase in dollars for each state in 2019. For example, in Tennessee, the 2019 annual premium for a benchmark plan for a 40-year-old would be $1,727 higher due to the two Trump administration policies. While premium tax credits may cushion the blow of rate increases for lower-income enrollees, unsubsidized consumers will pay for the premium hikes out of their own pockets. Results for all states are displayed in Table 1.

To generate a baseline estimate of 2019 premiums in the absence of these two policy actions, CAP first used 2018 state data of average benchmark marketplace premiums for a 40-year-old—trending these data forward to 2019 using Covered Californiafs estimate of 2019 medical trend. Then, CAP used the Urban Institutefs projections to estimate in dollars the state-by-state premium increases attributable to the repeal of the individual mandate penalty and the proposed short-term plan rule.

Although these estimated premium increases are significant, the cumulative premium increase is even greater. After all, through previous acts of marketplace sabotage, the Trump administration has already unnecessarily driven up 2018 premiums for ACA-compliant coverage. For example, last year, CAP estimated that the Trump administrationfs decisions to cancel cost-sharing reduction payments and to undermine enforcement of the individual mandate would increase average benchmark premiums for a 40-year-old by $1,061.

The Trump administrationfs repeal of the individual mandate penalty and proposed short-term plan rule are a continuation of a long trend of actions that have weakened the individual market risk pool and have increased marketplace premiums.

Thomas Huelskoetter is the policy analyst of Health Policy at the Center for American Progress.